It’s been a long time since I posted last time. From this time, I would like to write about the “Problem Solving: Practice Edition”. As the first one, I would like to take up “consideration of strategic options and decision-making”, which is common theme in problem solving. Using business school case studies as materials, I would like to think about solutions by actually utilizing problem-solving techniques.

The case study is shared by MIT and the original copy is here. I’ve summarized it below as it’s a little long. So please don’t worry lol. The information is a little old (around 2008), so if you read it now, you may feel some discomfort, but please take it as given. So, let’s read first!

Background of the case study

Four years after its founding in 2004, Lucky Air had grown into a US$104.3 million low-cost airline, serving domestic routes from Yunnan, one of China’s top tourist destinations. The Chinese airline industry was heavily regulated, limiting flexibility for new airlines. Nonetheless, there were 11 low-cost Chinese airlines, and two more waiting for official approval. Anticipating a potential squeeze, Lucky Air was searching for additional competitive advantages.

One option was to focus on e-commerce. Lucky Air’s IT operation was backed by Hainan Airlines, which had one of the most advanced web portals in the Chinese airline industry. True, airline e-commerce was still at an early stage in China. Lucky Air’s executives had to decide what was right for their company, customers, and market.

Issues to be solved

These are the issues of the case study. Many of you must have experienced this kind of problem-solving project, right?

1. What are Yunnan Lucky Air’s best options?

2. What factors should its executive team consider?

First, let’s take a look at the case summary. At timing like this, we need to organize the information by using framework, right? When dealing with this kind of problem, I think “3C” is the best to start with.

Summary: Customer

Passenger Aviation in China

– The Civil Aviation Administration of China anticipated an average annual growth rate of 15% for air traffic up through the year 2020.

– An increasingly large percentage of these passengers traveled for vacations and leisure and paid the airfare themselves. A wave of new low-cost airlines had emerged, making domestic travel more affordable for everyone.

– Analysts estimated that by 2013 25% of passengers would be carried by low-cost airlines with a projected growth rate of 20% per annum.

Airline Ticket Distribution System

– In China a passenger could buy an airline ticket directly from an airline, an authorized agent, or an online distributor.

– When passengers bought tickets directly from an airline, the airline had to pay a Global Distribution System (GDS) fee to government-owned TravelSky, the only GDS in China.

– When buying tickets from an authorized offline agent, Lucky Air and other airlines had to pay a commission ranging from 2% to 15% to the ticket agent.

– Off-line travel agents were the dominant ticket distribution system in China. For passengers, the ticket delivery was free and convenient. Moreover, the face time with the agent gave passengers additional reassurance in case questions.

Airline E-commerce in China

– The e-commerce sector remained relatively unsophisticated. Transaction security was often poor and payment systems expensive or unavailable, so only 15.8% of Internet users were online buyers.

– Credit card penetration in China was less than 4%, compared to 90% in the United States. And the online travel market in China was relatively small, less than 1% of the total travel market.

Summary: Competitor

– There were 11 low-cost Chinese airlines, and two more waiting for official approval.

– The two largest players were Ctrip and eLong, together dominating 75% of the online travel market share.

Summery: Company

Company history

– Lucky Air was founded in 2004. Between 2007 and 2008, the number of projected arrivals was predicted to increase from 21 million to over 24 million.

– The limited route license granted by the government gave Lucky Air a near-monopoly status within Yunnan and these routes contributed to most of its profits. As it grew, however, Lucky Air gradually added flights to and from destinations outside the province.

– Lucky Air had positioned itself as a low-cost, high-efficiency airline and adopted most of the key components of the Southwest Airlines model. * Southwest Airlines model: By using a single type of aircraft it reduced maintenance and operational complexity. / It operated mostly in secondary cities to avoid congestion and reduce landing costs, etc.

– However, unlike low-cost airlines in the United States and Europe that could achieve a roughly 30% cost advantage, Lucky Air’s cost structure was only about 5% lower than the industry average, mostly due to government-imposed constraints.

– Lucky Air’s four largest cost components – fuel, landing fees, aircraft leasing, and taxes – comprised about 70% of its operating cost, yet these costs were heavily influenced by government regulations.

Luckyair.net

– One of Lucky Air’s strengths was its IT operations. It depended on its parent company, Hainan Airlines.

– Its website, luckyair.net, was the first in the industry to enable online credit card verification and create an online community for its passengers.

– Luckyair.net offered a menu of services. Customers could buy and refund tickets online, paying 5% to 20% less than anywhere else.

– Lucky Air did not have a call center back-end operation. All online transactions – searching, booking, paying, and validating – were online. To Lucky Air’s executive team, the website appeared to be a promising way to emulate overseas airlines’ best practices and keep ahead of the Chinese competition.

– Lucky Air sold about 80% of its tickets through agents, paying them a 2% commission, and the rest through its own website.

Problem Solving!

That’s it for the content summary. Now let’s solve the problem!

Issue1. What are Yunnan Lucky Air’s best options?

In such cases, the divergence and convergence approach can be used. First, for divergence, prepare some options, and for convergence, select the best option.

First, we need to prepare some options. For this kind of strategic options, it would be good to consider them by using the 4Ps as a framework. First, identify possible elements for each P.

Product: “Continue expanding routes” or “Focus on Yunnan”

Price: “Value price (low cost)” or “Premium (high end)”

Place: “Increase the ratio of agents” or “Focus on E commerce” or “E commerce & Launch Call Center(for High end)”

Promotion: “Proactive” or “Not so proactive”

Then combine these elements to prepare options.

Issue2. What factors should its executive team consider?

Once all options are available after divergence, it is time to go into convergence. For convergence, I previously introduced the method of using the payoff matrix and PICK chart, but this time I would like to try the method of setting the evaluation axis (criteria). These criteria are the factors that the executive team should consider.

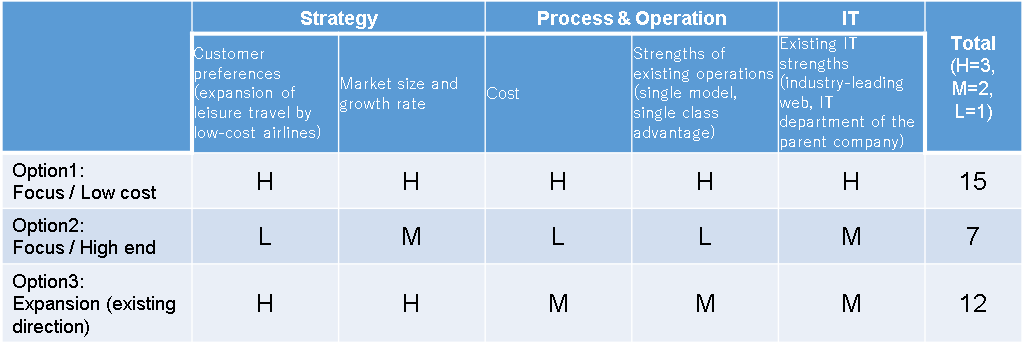

Frameworks can also be used to think about criteria. There is a lot of information on strategy and IT, so let’s use “Strategy/Process/Organization/IT” (This time, I changed “organization” to “operation” based on the given information. Let’s customize the method like this flexibly.).

Strategy

– Customer preferences (expansion of leisure travel by low-cost airlines)

– Market size and growth rate

Process & Operation

– Cost

– Strengths of existing operations (single model, single class advantage)

IT

– Existing IT strengths (industry-leading web, IT department of the parent company)

Now let’s evaluate each of the strategy options we created earlier based on the criteria above.

From these, “Option1” is the best! I came to this conclusion. Of course, this is not the only right answer, I think there would be various conclusions depending on the discussion (business schools are like that. The process of coming up with an answer is more important than the answer itself).

If you already know how to solve the problems, I think you can do it by your own way. If you don’t know how to do it, if you remember the method I wrote this time as one way, I think you can do “Quick Problem Solving”!

Also, since this was a case study, we already had a certain amount of information, but when we actually solve the problem, we need to start by collecting this information. Please find this link here for that.

Finally, what happened to Lucky Air after that. It seems that they have expanded their routes by following the existing direction like Option3 (link – sorry this link is in Japanese). However, it seems that the parent company, Hainan Airlines, has gone bankrupt due to impact of the corona virus. Since it is said that the flight will continue, all the best for their future.

That’s all for this time, and I would like to continue from the next time onwards. Thank you for reading until the end.